tax service fee fha

Review what you have uploaded. The monthly payments for this type of loan are roughly 10 percent to 15 percent higher per month than the.

Presenting The Fha Product Workshop Ppt Download

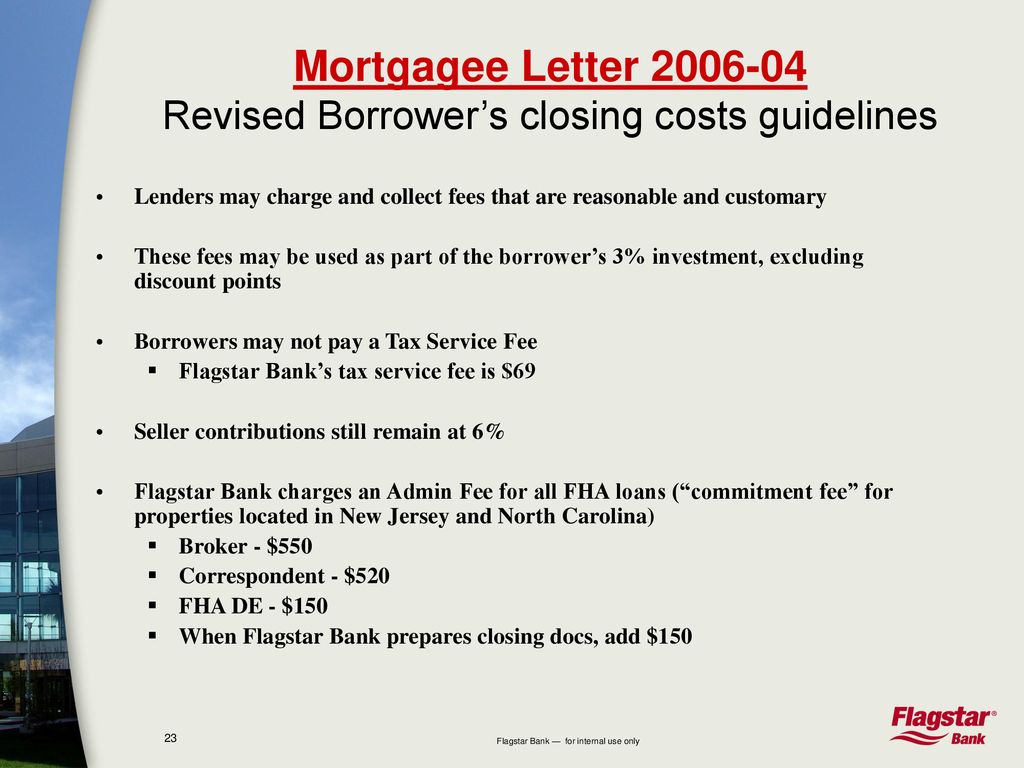

FL HFA PREFERRED PROGRAM FEES 85 Tax Service Fee deducted by US Bank at time of loan purchase 225 Compliance Fee payable to eHousing 200 Funding Fee deducted by US.

. Tax service fees are closing costs that are assessed and collected by a lender as a means of making sure that mortgage holders pay property taxes in a timely manner. FHA Loan Questions. 1644 Ann St Piscataway NJ 08854-1759 is a single-family home listed for-sale at 390000.

Home is a 5 bed 20 bath property. Home is a 3 bed 10 bath property. 10000 Tax Appeal Estate Appraisals.

Scan document into PDF. Create the tax forms. But a fee for our services will.

Foreclosure filings rose 42 last year compared to 2005 to 12 million filings nationally according to the firm RealtyTrac Inc. View more property details sales history and. Pay any taxes or fees by eCheck and.

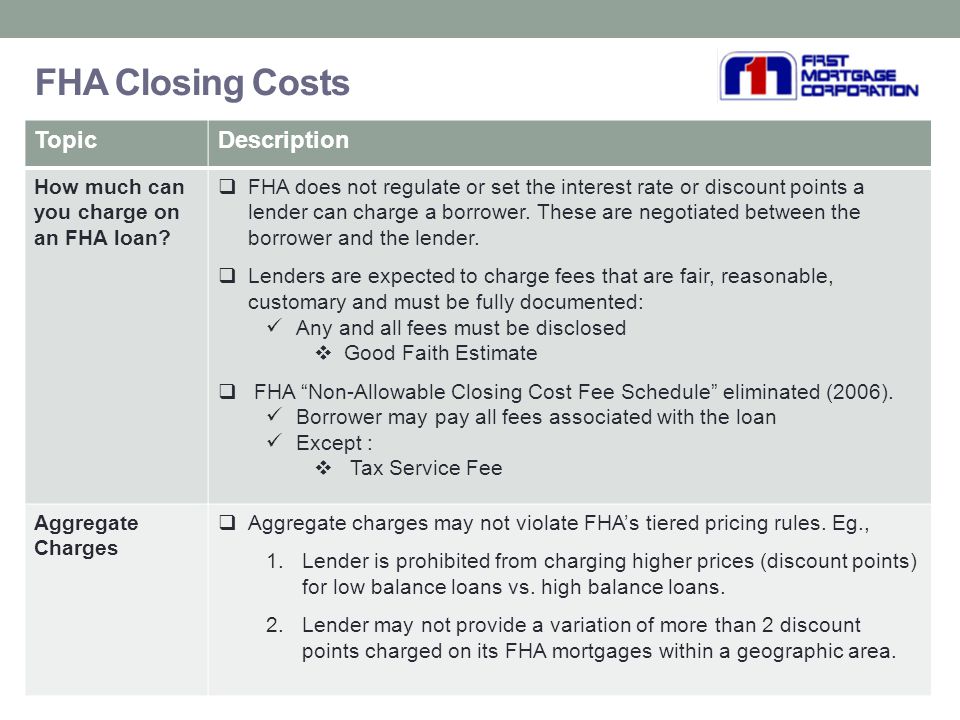

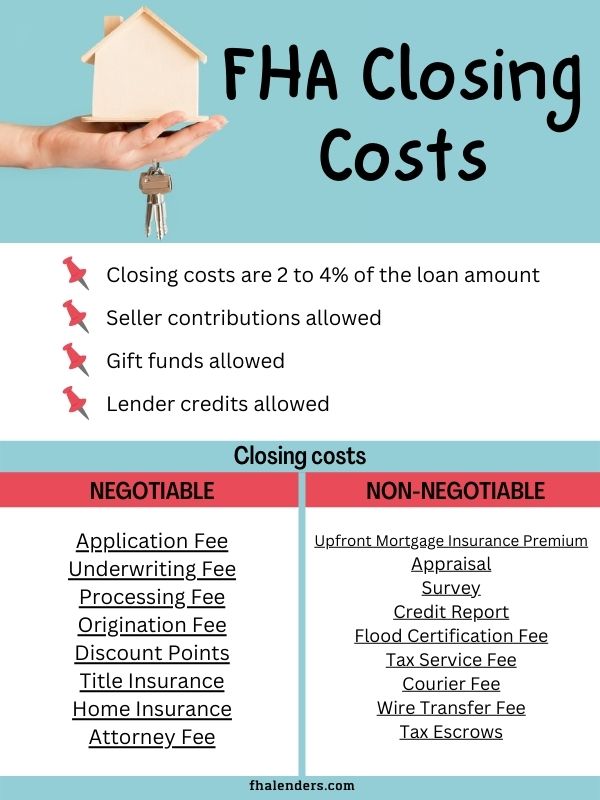

A tax service fee is paid by mortgage borrowers to mortgage lenders to ensure that a mortgaged propertys property taxes are paid on time. The one percent fee cap was eliminated for loans originated after that time but the FHA does not allow the lender to charge a tax service fee. Any Messenger Fee incl.

The FHA rules are designed to give clear guidance. View more property details. Termite Fees or Work Charges.

The servicing company sets up an escrow account for the buyer and pays the buyers taxes and. Tax Service Fee 50 This fee is paid to. The possible disadvantages associated with a 15-year fixed rate mortgage are.

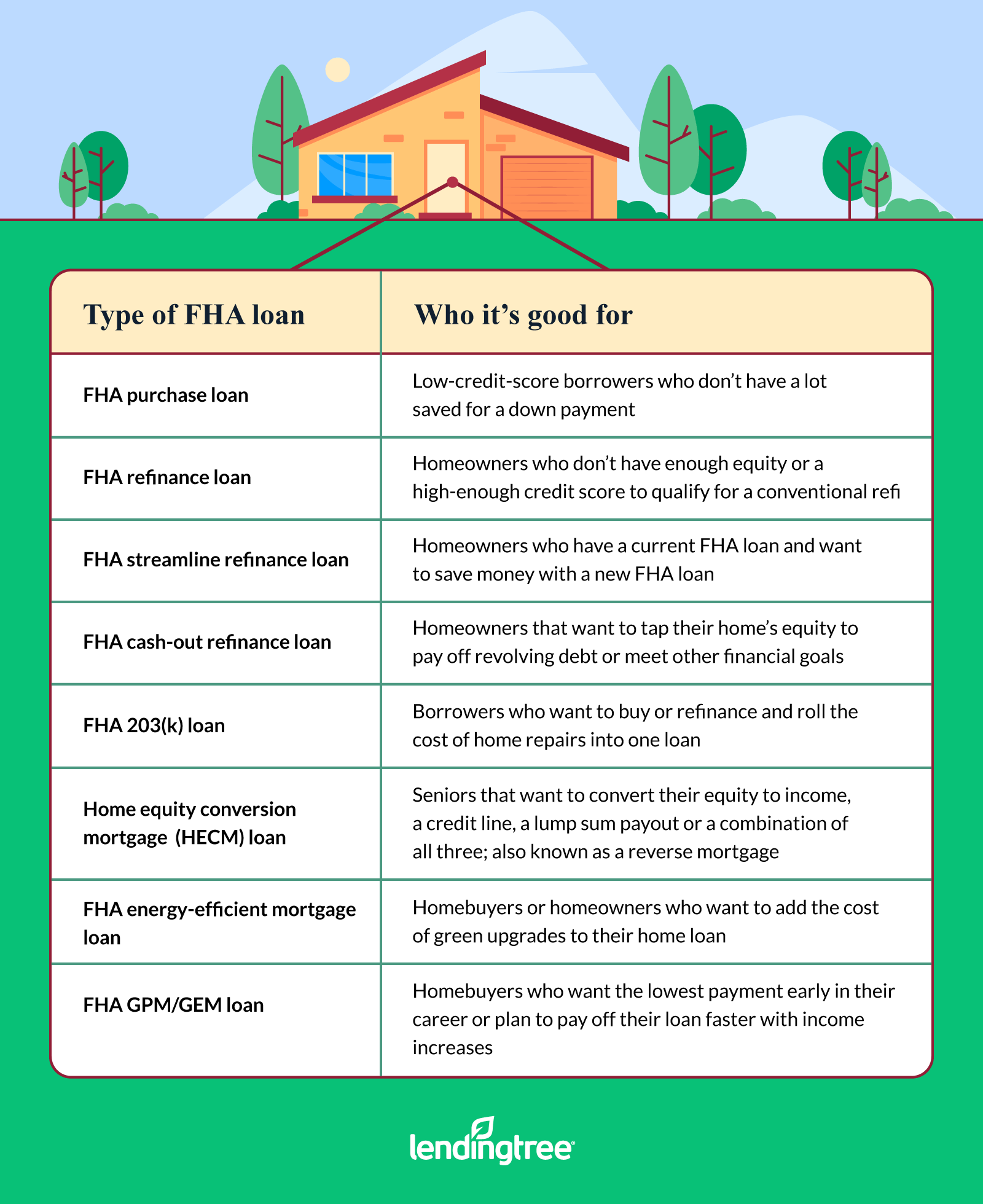

What is a tax service fee FHA. Can you charge a tax service fee on an FHA loan. The tax service fee is typically paid by the buyer to the lender at the time the home is purchased.

1084 Stelton Rd Piscataway NJ 08854-5201 is a single-family home listed for-sale at 325000. The seller or lender must pay the non-allowable tax service fee which typically costs about 25 to 75 according to the Good Mortgage website. We Guarantee Your Satisfaction.

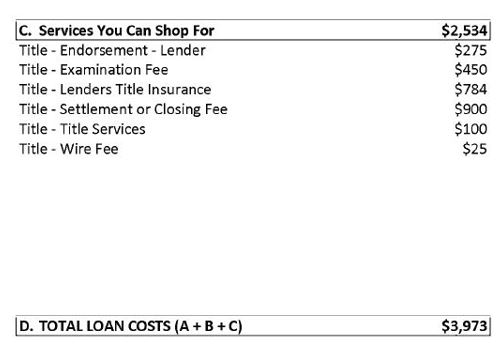

FHA - Single Family. How Does a Tax Service Fee Work. Recording Fee - Balance above 1700.

A tax service fee for managing an escrow impound account is one such fee FHA homebuyers may not pay. If you are not 100 satisfied with your return or the process let us know before we file and we will make it right or you owe us. According to the National Society of Accountants the average fee in 2020 for preparing Form 1040 with Schedule A to itemize personal deductions along with a state.

A tax service fee directly benefits the loan servicing company or the. Simply put a tax service fee is paid to the company that services the loan. Create a cover page.

More than 40000 foreclosure filings occurred. A reader got in touch with us recently to ask a question about the allowable fees and expenses associated with FHA.

The Fha Home Loan Process Step By Step Cis Home Loans

What Are Fha Loan Closing Costs The Ascent By Motley Fool

Conventional Vs Fha Vs Va Loans Best Mortgage For You Bankrate

Closing Costs Prudential Lucien Realty

:max_bytes(150000):strip_icc()/text-sign-showing-hand-written-words-fha-home-loan-1179800155-9e745cb5bb5f49279651d7a9e76096ac.jpg)

Federal Housing Administration Fha Loan Requirements Limits How To Qualify

Fha Closing Costs Complete List And Estimate Fha Lenders

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

U S Bank Home Mortgage Mrbp Nifa Housing Innovation Marketplace Conference Fha Updates January 25th Ppt Download

Fha Loan Requirements How To Qualify Better Mortgage

What Is An Fha Loan 2022 Complete Guide Bankrate

Understanding Closing Costs Sirva Mortgage

Consolidated Financial Management Tax Services Home Facebook

Fha Closing Costs Complete List And Estimate Fha Lenders

Fha Closing Costs Complete List And Estimate Fha Lenders

Homes For Sale Real Estate Listings In Usa Real Estate Tips Buying First Home Selling Real Estate

Start A Business Kbg Tax Services